SOFIN (SOCIAL FINANCIAL NETWORK) -P2P-lending service online. This is a market platform that unites creditors and borrowers: (1) Creditor - individual, bank, microfinance and fund organization; (2) Borrowers - individuals, entrepreneurs and individual organizations Loans are given in the currency of the country where the borrower is located. This allows the currency to be exchanged through a SOFIN token if the creditor and borrower are from different countries.

Choose the best loan terms, create legal bundles and earn money online from any device!

See the demo

PreICO Price 1 SOFIN = 0,5-0,8 USD

Price 1 SOFIN = 1-2 USD

Soft stamp 9850000 USD

Hard cap 157850000 USD

State of Russia

- 2010 The Rostov region guarantees funding of the creation of a structure that allows entrepreneurs to obtain the necessary funds through a guarantee fund. In three years, the guarantee amount is $ 51 million.

- 2011 Offline MFO Expressmoney Opens a network of microloan points where verification of the private (individual) borrower, legal basis and a very favorable financial model is obtained. The business was successfully sold.

- 2012 Opens Verum legal office The company provides legal support for construction and investment projects, including foreign investment. The verum-law.ru team of seven people formed the SOFIN Corporate Law Service.

- 2013 Miming rigs, cryptotrading Creation of own mining rig. Extensive experience in trading cryptocurrencies, investing in cryptoprojects.

- 2013 Opens IT company Elonsoft Team building with experience in international internet project development, including creation of MVP for beginners. Now there are 16 programmers who will work on SOFIN platform after ICO implementation

- 2014 Private P2P Loans to Entrepreneurs Since 2014 and up to now, a successful experience connects people with money and legal people who need credit. The interest rate allows each party to earn an income. Until now, there is no refund. Currently, the loan portfolio exceeds $ 1.5 million.

- August 2016 P2P platform concept Ideas for creating a market financial source on a single window system where individuals and companies can obtain loans from people, MFOs, banks. With minimum and transparent levels in auction mode.

- August 2016 Launch of MFO Loan Loan Build a loan and verification system for online borrowers (clubzaimov.ru). Software development assessment, integration with the system of credit history and online processing. Gain experience of attracting borrowers on the Internet. In this project, we have done all the essential elements of the future P2P platform, and there are 14 people working in the company.

- July 2017 - to date Commencement of system development The definition of financial development model. Appointment of technical part of platform, interface design, and business logic programming.

- November 6, 2017 preco Fund raising to complete the platform, output of SOFIN tokens on ICO, white paper adjustments and business model adjustments based on investor feedback and cryptoomunity.

- December 11, 2017 ICO Fund raising for platform development, output token on the exchange, establishment of Guarantee Fund and international expansion.

- Q1 2018 Tokens on the stock The public offering of SOFIN tokens on the cryptocurrency exchange for free offers. Implement the token-support strategy and increase it to $ 20. The direct correlation between the growth rate and loan repayment on the platform is accomplished by returning the SOFIN token for transaction bonus payouts set in the platform

- Q1-2 2018 Launch of platforms in Russia and Guarantee fund options The first issue of loans through SOFIN platform from our MFO partners, initial followers, and our own funds. Once the guarantee fund has been launched and the risk of payment has been reduced, the plan will attract a large number of creditors.

- Q3-4 2018 Platform launches in CIS countries Generate loans in Russian-speaking countries, starting with Georgia and Kazakhstan and next steps in Ukraine and Belarus. In each country where we will issue a loan, the local office will be opened to interact with the country's verification, rating and credit rating system. 100% legal purity, which is the hallmark of our platform, will be provided. In the same way, local partners in each country are planned for loans. Target 2018 - 1 $ million

- 2019 Launch of one country per quarter Large promises and emerging markets for P2P loans are concentrated in the region: Asia, Africa and Latin America. The first countries outside the CIS where we start lending will be Myanmar and Cambodia.

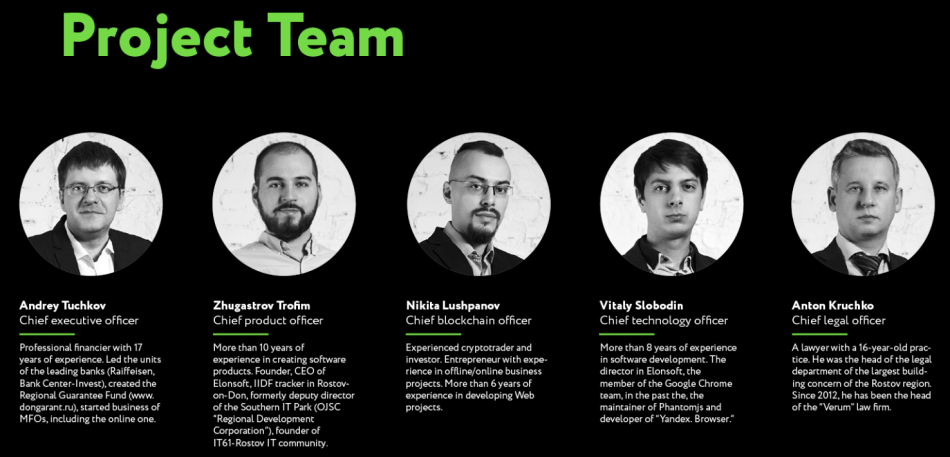

Team

For more information:

Official website: https://sofin.io/

Bitcointalk: https://bitcointalk.org/index.php?topic=2257607

Twitter: https://twitter.com/sofinplatform

Facebook: https://twitter.com/sofinplatform

Telegram: https://t.me/sofin_ru

Author: indah333

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1724885

Eth: 0xf16486c792628e08D0D32995b0EB9e90fea27692

Tidak ada komentar:

Posting Komentar